In a conclusive move to animate advancement and sharpen its corporate center, Johnson & Johnson (J&J) has pronounced its point to apportioned its sprawling Orthopedics business, DePuy Synthes, into a unused, independent unreservedly traded company. This key divestment, expected to be completed interior 18 to 24 months, marks the minute major portfolio modifying by the healthcare total in afterward a long time, taking after the 2023 spin-off of its Client Prosperity division, Kenvue.

The division focuses to make two specific, high-performing substances: a leaner, more centered J&J concentrating on its high-growth Innovative Medicine (Pharmaceutical) and remaining MedTech parcels, and a forcing standalone around the world pioneer in the $50 billion+ orthopedics market.

Background and True Context

The Orthopedics commerce, which made around $9.2 billion in bargains in money related year 2024, is built up in the basic acquisitions of the last two decades. The center of the unit is DePuy Synthes, a title that reflects two point of intrigued deals.

- DePuy: J&J to start with gotten DePuy, a company set up in 1895 and known for its orthopedics and neurosurgery things, in 1998.

- Synthes: The most transformative step came in 2012 when J&J completed its securing of Swiss remedial contraption maker Synthes for generally $20.2 billion, its largest-ever deal at the time. This integration built up the DePuy Synthes Companies of Johnson & Johnson, making what was, and will once once more be, the greatest and most comprehensive orthopedics-focused company in the world, specializing in embeds for hip, knee, and bear substitution, damage things, and spinal devices.

However, in show disdain toward of its driving exhibit position, the orthopedics segment has dynamically been characterized as a lower-growth market compared to J&J’s other MedTech and Inventive Pharmaceutical zones. The division has as well gone up against vital operational challenges and had as of presently experienced a cost-cutting and grandstand pull back revamping in 2023.

Current Industry Designs Driving the Split

J&J’s choice is exceedingly cleverly of both interior imperative needs and broader designs clearing through the helpful contraption (MedTech) and biopharma industries:

- The Intrigued of Higher Improvement and Margins

J&J’s organization has unequivocally communicated that the spin-off is “all around contracting to create faster.” The company is purposely moving its MedTech portfolio toward higher-growth, higher-margin markets, a method exemplified by afterward multi-billion dollar acquisitions of companies in the Cardiovascular and Robotic Surgery spaces (e.g., Abiomed for cardiovascular contraptions and Shockwave Medical).

In separate, the center orthopedics exhibit, particularly create things like hip and knee embeds, is routinely seen as a commodity-based commerce with more noticeable evaluating weight and competition, driving to more humble advancement rates.

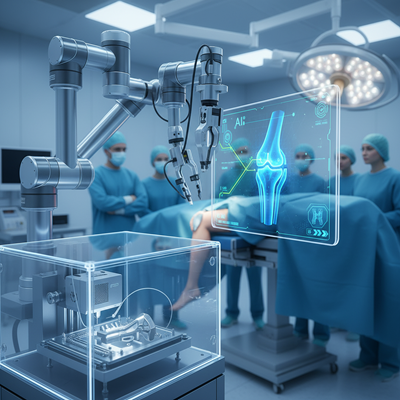

- Mechanical Headway and Robotics

The orthopedics promote is being revolutionized by surgical robotics, AI, and 3D printing. Robotics-assisted methodologies for hip and knee substitutions are getting to be standard, growing the require for huge R&D wander in specialized stages. As a standalone substance, DePuy Synthes would have more vital budgetary and key versatility to center capital on making and commercializing its have next-generation development, such as its orthopedics robot, to stay competitive with rivals like Stryker and Zimmer Biomet.

- Industry-Wide Divestitures

The spin-off is parcel of a greater incline of totals breaking isolated to make pure-play companies. A few other major biopharma and MedTech players, tallying Novartis, GSK, and GE Healthcare, have executed comparative divestitures in afterward a long time to unburden slower-growth units and open more noticeable shareholder regard by concentrating on center, creative, high-potential segments.

Expert Conclusions and Implications

The reaction from inspectors and industry pros is to a incredible degree positive, seeing the division as a value-accretive move for both entities.

Implications for Johnson & Johnson

For the remaining J&J, the move is expected to enliven top-line advancement and move forward working edges. CEO Joaquin Duato communicated the trade will allow the company to “energize fortify its center and hypothesis toward higher-growth areas.”

- Focus Districts: Post-separation, J&J’s center parts will center around Inventive Pharmaceutical (Oncology, Immunology, Neuroscience) and the remaining MedTech businesses: Cardiovascular, Surgery, and Vision.

- Acquisition Pipeline: A more streamlined center appear free up capital for help imperative acquisitions in districts of tall ignored helpful require and tall inventive improvement, such as advanced surgical gadgets and specialized cardiology devices.

Suggestions for DePuy Synthes

The present day, free company, DePuy Synthes, will celerity as the greatest committed orthopedics company in the world.

- Centered Specialist: Industry experienced Namal Nawana, the past CEO of break even with helpful tech firm Smith & Nephew, has been named to lead the exchange through the division and is expected to continue as CEO of the standalone company. This course of action signals a commitment to commanding, specialized management.

- Market Position: As a standalone substance, DePuy Synthes will be prevalent arranged to particularly compete with orthopedics-focused peers like Stryker and Zimmer Biomet. A more centered commerce illustrate will allow the company to assign resources solely to progression, supply chain optimization, and commercial capabilities interior the orthopedic space. Inspector John Boylan of Edward Jones popular that the move should to allow the company to “put more resources on headway and penetration of its surgical robot as a stand-alone business.”

The spin-off is a clear hail that J&J acknowledges specialization is the key to outperformance in a rapidly progressing, inventively complex healthcare scene. By taking off a part that, though profitable, slacked behind in the by and expansive improvement of the wander, J&J is committing its resources to getting to be a more handy, innovation-driven pioneer in the fastest-growing corners of pharmaceutical and restorative innovation.