The cash related recovery of U.S. clinics and prosperity systems, as of presently a sensitive and uneven plan taking after the broad, is directly encountering basic headwinds that weaken to crash development. Though add up to figures show up a slight alter in working edges from the lows of 2022, a closer see at the data reveals a portion still doing combating against a persistent surge in operating expenses and a creating slate of course of action and promote vulnerabilities. Various Hospitals, particularly nation and safety-net workplaces, remain in a regrettably incline money related state, removed from the pre-pandemic financial dauntlessness masters consider fundamental for long-term resilience.

Background and Chronicled Setting: The Pre-Pandemic “Normal”

For the decade going some time recently the COVID-19 broad, the center working edge for U.S. prosperity systems by and expansive coasted between 2.2% and 3.6%. These incline edges, without a doubt in a unfaltering environment, signaled a challenging portion, but one for the most portion competent of supporting operations and making fundamental capital investments.

The far reaching crushed this sensitive concordance. Working edges dove to thrilling negative figures in 2020 as elective strategies were canceled and costs for person cautious equipment (PPE) and passing labor taken off. Government lightening saves given a basic, in show disdain toward of the truth that passing, life saver, driving to a brief, dishonestly tall bounce back in a few estimations in 2021. The year 2022, in any case, checked the nadir of the money related crisis, getting to be one of the most financially challenging a long time in afterward memory, with various systems specifying a negative center operating margin for the to start with time in years.

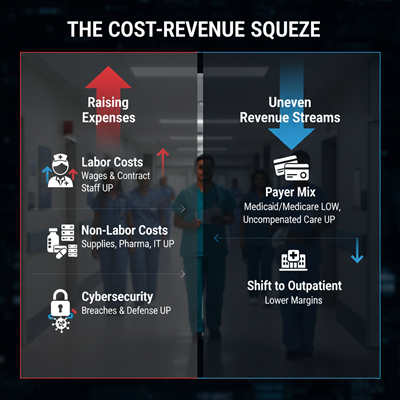

Current Designs: The Cost-Revenue Squeeze

Recent data appears that the incremental recovery seen in 2023 and early 2024 has to a awesome degree moderated down or turned around for a critical allocate of the industry. The fundamental driver is a extraordinary cumbersomeness between rising costs and obliged pay growth.

- Raising Expenses

Hospitals continue to be tormented by eminent swelling, with costs outpacing modest increases in reimbursement rates:

- Labor Costs: While reliance on high-cost contract or “travel” labor has declined from best far reaching levels, by and huge labor costs remain tall. Compensations for key clinical parts, such as enrolled restorative specialists, have seen advancement rates basically speedier than the common swelling rate. Labor still constitutes the single greatest working fetched for most systems.

- Non-Labor Costs: This category is by and by the fastest-growing budgetary weight. Supply costs, pharmaceuticals, and obtained organizations (such as IT, counseling, and specialized upkeep) have seen sharp year-over-year increases.

- Cybersecurity: The taking off brought of soothing cyberattacks, which can aggravate determined care and taken a toll millions per breach, incorporates another basic, non-clinical expense.

- Uneven Wage Streams

While net salary continues to create, it is not keeping pace with costs, and volume remains uneven:

- Payer Mix: Clinics commonly work at a mishap on Medicare and Medicaid patients, depending on commercial securities for their edge. Course of action changes, such as the extricating up of diligent Medicaid enrollment, are driving to millions of people losing scope, growing the burden of uncompensated care and terrible commitment for hospitals.

- Shift to Outpatient: Salary improvement is dynamically coming from outpatient organizations, which tend to have unmistakable, as often as possible lower, edges than customary inpatient care, complicating cash related planning.

Expert Suppositions: Recovery is Sensitive, Not Complete

Financial analysts and industry pioneers by and large agree that the industry’s modest add up to edge recovery is significantly fragile and covers wide distress.

“While the center working edge is inching toward break-even for the industry as a aggregate, recovery is removed from certain at the organization level,” notes one cash related ace. The reality that around two out of five clinics are still reporting negative working edges in a period of add up to upgrade underscores the significant and localized nature of the cash related crisis.

Experts additionally emphasize the qualification between a hospital’s working edge (center commerce) and its net pay (joins non-operating components like wanders). Various systems reporting an in common “advantage” in afterward periods did so basically due to strong wander returns in the cash related markets, not upgrades in their center understanding care operations. This reliance on non-operating pay makes a hospital’s money related prosperity defenseless to exhibit volatility.

Suggestions and The Drawing closer Threats

The postponed cash related instability of U.S. mending centers carries veritable recommendations for determined get to, quality of care, and the for the most part healthcare ecosystem.

- Danger of Closures and Advantage Cuts

The most fast risk is to common and safety-net clinics. These workplaces frequently serve a too much tall share of low-reimbursing government payers (Medicare/Medicaid) and uninsured patients. Financial related extend places them at a expanded chance of closure or arranging of fundamental organizations, such as obstetrics or damage care, which are routinely cash related channels but essential to community health.

- Potential Deterioration of Quality

Research proposes a positive relationship between strong financial related execution and high-quality, secure understanding care. Recuperating centers with relentless accounts are predominant able to contribute in state-of-the-art development, progressed system, information systems, and, direly, high-caliber, well-trained staff. Bolstered budgetary weight can lead to conceded capital theories, strained nurse-to-patient extents, and a more conspicuous risk of opposing calm outcomes.

- Policy-Driven Headwinds

A run of course of action vulnerabilities debilitates to raising budgetary torment in the coming years:

- Expiration of ACA Gifts: The moved forward premium charge credits underneath the Sensible Care Act (ACA) are set to end, which appear result in millions of Americans losing scope or going up against radically higher premiums. This would disentangle particularly into a sharp increase in uncompensated care for hospitals.

- Looming Medicaid Cuts: Essential Medicaid subsidizing cuts are slated to take affect in the near future unless Congress intervenes, direct undermining the dissolvability of recuperating centers that serve a sweeping Medicaid population.

In response, various clinic pioneers are centering on powerful cost-management strategies, tallying optimizing labor effectiveness, updating their pay cycle organization, and animating the determination of value-based care models to secure long-term, doable cash related quality. The current diminutive is a pressing one, asking flexible organization and crucial foresight to investigate the complex monetary and approach scene.