The race to develop the next generation of life-saving medicines—from complex biologics and mRNA vaccines to personalized cell and gene therapies—has collided head-on with a decades-old constraint: the sterile manufacturing bottleneck. Contract Development and Manufacturing Organizations (CDMOs), the industry’s engine of outsourced production, are scrambling to expand capacity in the highly specialized area of sterile fill-finish, creating a dynamic landscape defined by high demand, constrained supply, and massive strategic investment.

Background and The Road to the Crunch

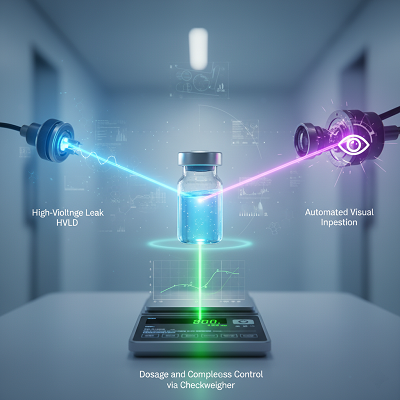

The sterile fill-finish process—aseptically placing a drug substance into its final container (vial, syringe, or cartridge)—is arguably the most critical and technically demanding step in the drug supply chain. Any compromise in sterility can be catastrophic.

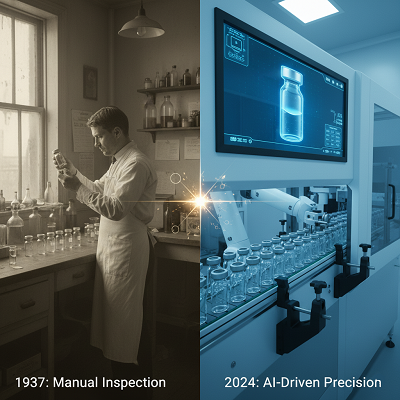

Historical Context: From Integration to Outsourcing

For much of the 20th century, large pharmaceutical companies operated on a vertically integrated model, controlling everything from discovery to final packaging. The rise of the modern CDMO era in the late 1990s and early 2000s, spearheaded by companies like Lonza and Catalent, was a direct response to the biotech revolution. As drug compounds became complex biologics, requiring niche expertise and costly, specialized equipment, Big Pharma began to divest non-core manufacturing assets.

CDMOs stepped in, offering economies of scale and expertise. However, this decentralized model, while driving innovation, created a highly concentrated pool of sterile fill-finish providers.

The Perfect Storm: Drivers of the Current Crisis

The current capacity crunch is a culmination of several powerful factors:

- The Biologics Boom: Newer therapies—monoclonal antibodies, fusion proteins, and gene therapies—are overwhelmingly injectable, requiring sterile processing. Their delicate nature also precludes traditional terminal sterilization, mandating more complex aseptic fill-finish using advanced isolator technologies.

- The COVID-19 Effect: The pandemic consumed an enormous percentage of the global fill-finish capacity for vaccine production, creating a massive displacement effect that squeezed out clinical and commercial batches for non-COVID drugs.

- The GLP-1 Surge: The meteoric rise of blockbuster weight-loss and diabetes drugs (GLP-1s) is now placing unprecedented demand on high-volume auto-injector and pen-device filling capacity, further diverting resources.

- Regulatory Scrutiny: Agencies like the FDA and EMA are enforcing increasingly strict quality standards, such as the new EU GMP Annex 1, which often forces providers to halt operations for costly, time-consuming upgrades, temporarily shrinking available capacity.

Current and Upcoming Trends: The Strategic Response

The industry’s reaction to the capacity deficit is driving a new wave of CDMO strategic investment and operational evolution.

1. The Multi-Billion Dollar Capacity Race

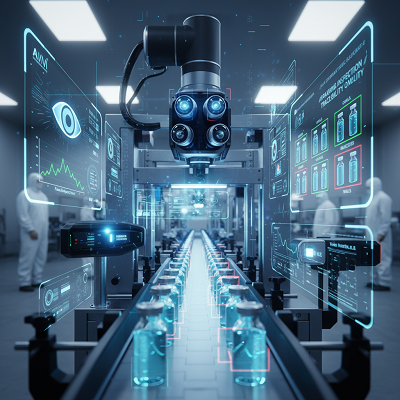

CDMOs and even large pharma companies are currently investing an estimated $1.5 billion to $2.0 billion in new sterile fill-finish capacity, with lines slated to come online between 2024 and 2026. This investment is highly focused on:

- Advanced Formats: Prioritizing capabilities for prefilled syringes (PFS) and cartridges over traditional vials, reflecting patient preference for at-home, easy-to-use delivery devices.

- Isolator Technology: Replacing older cleanroom technology with fully enclosed, automated isolator-based filling lines. This minimizes human intervention, dramatically improving sterility assurance and meeting the latest regulatory standards.

2. The Rise of “Small-Batch, High-Value” Expertise

For emerging biotech firms and developers of personalized medicine (like cell and gene therapies), the challenge isn’t high volume, but minimal product loss in small batches.

- Low-Loss Filling: Expert CDMOs are adopting specialized, low-loss filling pumps and tubing configurations to ensure that every milliliter of an expensive drug substance is preserved, a critical factor when a single batch may treat only a handful of patients.

- Decentralized Manufacturing: A nascent, yet powerful, trend is the move toward decentralized or point-of-care (POC) manufacturing for autologous cell therapies. This involves creating smaller, modular manufacturing networks closer to hospitals to address the logistical complexity and short shelf-life of these personalized products.

3. Deepening Strategic Partnerships

The days of transactional, arms-length contracting are over. The capacity crunch forces clients to seek integrated, long-term partners rather than vendors.

- Early Engagement: Drug developers are engaging CDMOs during the earliest phases (pre-clinical) to ensure the formulation and container strategy is designed for manufacturability from the start.

- Transparency and Resilience: Clients demand greater supply chain integration and transparency to mitigate the risk of disruption, moving toward “single-source” models where a single CDMO handles both drug substance and drug product, eliminating risky vendor handoffs.

Expert Opinion and Industry Implications

Ian Tzeng, Managing Director and Partner at L.E.K. Consulting, summarizes the market outlook: “The fill-finish market remains a strong opportunity because new demand typically outpaces capacity’s ability to grow or adapt. This dynamic is likely to persist for the next five to ten years despite significant investment.” The real challenge, he notes, is not just total capacity, but ‘right capacity’—finding the right format, throughput, and specialized handling expertise in the desired geography.

Implications for Public Health and the Biotech Ecosystem

The capacity crunch has serious implications:

- Increased Drug Shortages: The lack of available sterile capacity, exacerbated by the diversion of lines for blockbuster drugs, directly contributes to shortages of essential, often generic, sterile injectable drugs critical for hospital care (e.g., anesthesia, cancer treatments).

- Delayed Time-to-Market: Smaller biotech companies, which lack the leverage of large clients, face significantly extended timelines for securing fill-finish slots, translating into delayed access for patients awaiting new therapies.

- The “Quality-Price Paradox”: With CDMOs holding pricing power due to demand, there is a systemic risk that fierce price competition for generic sterile injectables could incentivize manufacturers to minimize quality investments, a factor cited in past drug shortage analyses.

In this high-stakes environment, the strategic partnership between pharma and CDMOs is not just about manufacturing—it’s about supply security. Success will belong to the CDMOs that can execute massive capital projects swiftly and flawlessly, while simultaneously mastering the operational complexity of advanced aseptic technologies for the next generation of medicine.