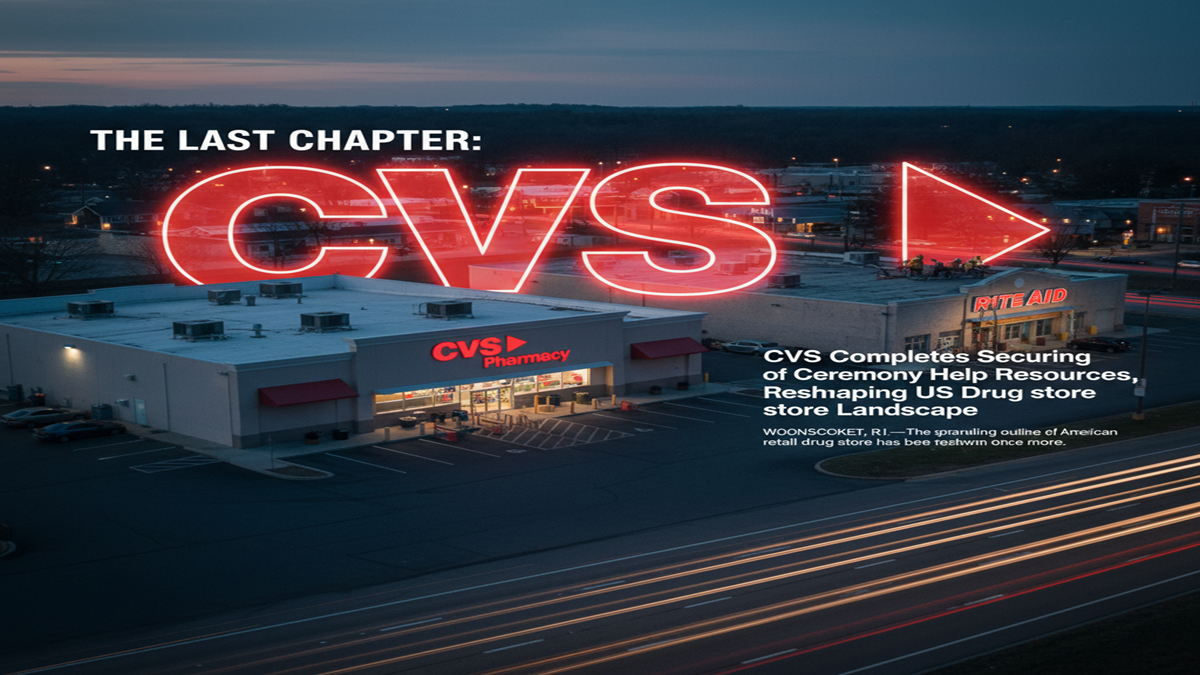

WOONSOCKET, R.I.—The sprawling outline of American retail drug store has been redrawn once more. CVS Drug store, a division of CVS health, declared nowadays the finalization of its securing of select Rite Aid resources across the nation, a summit of months of liquidation procedures and resource deals that signals the authoritative conclusion of the Custom Help brand as a major standalone force.

This key move sets the developing dominance of mega-chains in the U.S. healthcare division and brings over nine million previous Custom Help and Bartell Drugs patients beneath the CVS umbrella.

The Bargain in Detail: Extending Footprint

The finalized bargain, endorsed by the U.S. Insolvency Court in Modern Shirt, saw CVS procuring two essential components:

- 63 previous Rait Aid and Bartell Drugs stores in the Pacific Northwest states of Idaho, Oregon, and Washington. Bartell Drugs was a territorial chain procured by Ceremony Help in 2020.

- The medicine records of 626 previous Rait Aid and Bartell Drugs drug stores over 15 states.

CVS has expressed that most of the existing CVS Drug store areas accepting medicine records are intentioned found inside near proximity—often less than three miles—of the covered Ceremony Help stores, pointing to keep up understanding comfort and get to to care. To oversee the deluge of unused patients, CVS has enlisted more than 3,500 previous Custom Help and Bartell Drug colleagues and is making focused on ventures in its existing workforce and store capacity.

Len Shankman, Official Bad habit President and President, Drug store and Shopper Wellness at CVS Wellbeing, expressed that the procurement “maintain[s] and expand[s] get to to helpful and trusted drug store care over the U.S. and grow[s] our retail impression and nearness in nearby communities.”

Historical Setting: The Long Decay of a Drug store Giant

The resource deal marks the last chapter for Custom Help, a company that once stood as a retail drug store mammoth. Established in 1962, Ceremony Help forcefully extended through acquisitions in the 1980s and 1990s, at one point getting to be the biggest drugstore chain in the U.S.

The company’s battles escalates over the past two decades, characterized by monetary underperformance, administration change, and expanding competition. Significantly, the company’s money related balance was forever debilitated by legitimate presentation related to the national opioid scourge and a smashing obligation stack that come to about $4 billion.

Failed Mergers and a Retreat

Rite Aid’s later history is characterized by fizzled endeavors to discover a steady partner:

- Walgreens Bargain (2015-2017): Walgreens at first endeavored to secure all of Ceremony Help, but the bargain was eventually blocked by antitrust controllers. Instep, Walgreens obtained about 2,000 Custom Help stores and three dispersion centers.

- Albertsons Bargain (2018): A proposed merger with the grocery store chain Albertsons was called off after confronting noteworthy restriction from Ceremony Help shareholders.

These withdraws cleared out a littler, less geologically cohesive company incapable to viably compete with the coordinates models of its bigger rivals, CVS and Walgreens, driving to numerous liquidation filings, the to begin with in 2023 and the moment prior this year, which eventually brought about in the liquidation of all remaining assets.

Current Patterns: Solidification and the Coordinates Healthcare Model

The CVS procurement is not fair a commentary in Ceremony Aid’s death; it is a clear case of the winning patterns in the profoundly solidified US retail drug store and healthcare market.

The “Huge Two” Dominate

The advertise is presently overwhelmingly overwhelmed by CVS Health and Walgreens Boots Union. Both companies have moved forcefully to change from straightforward drugstores into coordinates healthcare providers.

- CVS Wellbeing works an coordinates demonstrate that incorporates its enormous retail drug store chain, a driving Pharmacy Benefit Manager (PBM) (CVS Caremark), and the wellbeing guarantors Aetna. The later acquisitions of essential care supplier Oak street health advance emphasize their move toward a comprehensive, end-to-end healthcare model.

- Walgreens has moreover sought after integration, in spite of the fact that its later move to possibly go private signals distinctive key challenges.

Focus on Essential Care and Convenience

Modern drug store chains are extending distant past medicine filling. The key patterns driving the division are:

- Expansion of Clinical Administrations: Drug stores presently broadly offer immunizations, inveterate infection administration, and essential care administrations through in-store clinics (like CVS’s MinuteClinic).

- Digital and Omnichannel Methodology: Companies are contributing intensely in domestic conveyance, mail-order drug store administrations, and advanced stages to meet shopper request for comfort, a drift quickened by the COVID-19 pandemic.

- Taken a toll and Get to: The never-ending weight on sedate estimating and the require to guarantee get to to care, especially in underserved communities, make drug store area and arrange consideration paramount.

Expert Conclusion: Concerns Over Competition and Quiet Experience

Healthcare investigators and industry specialists see the exchange as unavoidable given Ceremony Aid’s battles, but it does not come without concerns.

David Silverman, a senior executive at Fitch Appraisals, has already famous that Ceremony Aid’s failure to coordinate the national store systems of CVS and Walgreens made critical challenges for its incorporation in major pharmaceutical systems. “In case Ceremony Help were pitching themselves for consideration for an manager whose workers lived all over the nation, Ceremony Help basically couldn’t serve those clients,” Silverman commented.

The quick suggestion for patients is a alter of scene and drug store supplier. CVS keeps up that the exchange of medicine records guarantees “comfort for the community and continuous get to to vital prescriptions.”

However, the proceeded combination raises questions almost market competition. With a third major competitor completely expelled from the field, shopper backing bunches caution that the decreased choice might lead to:

- Less weight on medicate pricing.

- Fewer alternatives for personalized drug store care exterior of the two major chains.

- Potential for benefit disturbances or diminishments in staff as the retaining company centers on cost-cutting and edge improvement.

In specific, the integration of millions of modern patients into the CVS framework will test the capacity of its existing stores, a challenge the company is endeavoring to relieve by enlisting previous Custom Help staff and contributing in its current areas. This operational challenge—the fruitful, consistent integration of modern patients and systems—is where the extreme victory of the securing will be measured. The last decision, in the shape of understanding involvement and long-term benefit quality, will unfurl in the coming months.