Lawrence Furnstahl, the long-serving Official Bad habit President and Chief Monetary Officer of Oregon Health & Science University (OHSU), is set to exit his part in December to take on a unused authority position at the University of California San Diego (UC San Diego). This high-profile official movement marks a critical move for both major scholarly restorative centers, happening at a time when the broader healthcare industry faces strongly money related pressures.

🔎 Foundation and Chronicled Context

Mr. Furnstahl has been a foundational pioneer at OHSU for about 15 a long time, directing the Portland-based institution through a period of significant extension and complex money related challenges.

OHSU: A Residency of Growth

During his residency, OHSU experienced exceptional regulation development, which includes:

- A 66% increment in the number of employees.

- A 150% increment in revenue.

- A 125% increment in net worth.

He was moreover instrumental in exploring the budgetary complexities of the COVID-19 widespread and made a difference secure the notable $2 billion blessing from Phil and Penny Knight, a point of interest minute for the university.

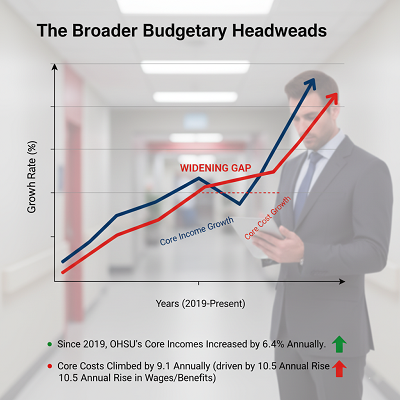

The Broader Budgetary Headwinds

Mr. Furnstahl’s takeoff comes as OHSU, like numerous major healing center frameworks over the nation, is hooking with noteworthy “auxiliary” budget challenges. The essential issue is a quickly broadening hole between income development and cost growth:

- Since 2019, OHSU’s center incomes expanded by 6.4% annually.

- Core costs climbed by 9.1% yearly, driven to a great extent by a 10.5% yearly rise in compensation and advantage costs.

This national drift of rising labor and supply costs exceeding repayment rates underscores the troublesome monetary climate in which OHSU must presently conduct a national look for a replacement.

🧭 The Modern Part: UC San Diego

Effective January 1, Mr. Furnstahl will expect the part of Bad habit Chancellor for Back and Organization at the College of California San Diego. This modern position places him in a broader, campus-wide authority part, managing the vital monetary arranging for the whole college, which includes:

- Strategic budgetary arranging and management.

- Budgeting and capital finance.

- Real domain management.

- Oversight of self-supporting income initiatives.

His ability in overseeing the funds of a huge, complex scholastic therapeutic center will be straightforwardly connected to one of the nation’s preeminent open investigate colleges and its wellbeing system.

📊 Current Patterns and Master Opinion

The development of a high-level fund official between two prestigious scholastic teach highlights a few key patterns in the healthcare and higher instruction sectors.

Trend 1: The Premium on Monetary Architects

The enrollment of a demonstrated monetary pioneer like Mr. Furnstahl reflects the expanding request for officials who can bridge the crevice between scholastic missions and monetary maintainability. Scholastic therapeutic centers are interestingly complex, adjusting clinical care, biomedical inquire about, and therapeutic instruction. UC San Diego’s choice to bring in a experienced who overseen a $5 billion working budget at OHSU signals their center on forceful, strategically-guided monetary arranging for future growth.

Trend 2: Healthcare Official Mobility

The move is portion of a broader slant of tall official turnover in the healthcare segment. Pioneers habitually move between frameworks, particularly those looking for to apply their involvement in distinctive or bigger markets. The hop from CFO of a particular wellbeing framework (OHSU) to a Bad habit Chancellor part supervising the funds of the whole college (UC San Diego) frequently speaks to an upward move in scope and scale.

Expert Supposition: The Look Process

OHSU has declared plans to title an intervals CFO whereas propelling a national look for a lasting successor. Industry examiners recommend that OHSU must emphasize a candidate with profound encounter in fetched control and income cycle optimization.

“Losing a CFO who was a key player in a 150% income increment is a major blow, particularly when OHSU is attempting to stabilize its edge,” states one industry spectator. “The unused CFO will require to be a turnaround pro who can stand up to basic taken a toll drivers, especially labor costs, whereas keeping up the institution’s commitment to its scholastic and clinical missions.”

➡️ Suggestions for Both Institution

Implications for OHSU

The essential challenge for OHSU is keeping up money related solidness and energy without a center pioneer at the helm.

- Risk of Insecurity: The look for a lasting CFO makes a period of potential insecurity as the institution navigates its quick budget challenges.

- Strategic Void: Mr. Furnstahl’s broad authentic information of OHSU’s major capital ventures, charitable connections (like the Knight blessing), and key arranging endeavors will be troublesome to supplant promptly. The between times period will require solid inner collaboration to guarantee venture continuity.

Suggestions for UC San Diego

UC San Diego is obtaining a money related pioneer with a track record of overseeing gigantic organizational development and complex subsidizing streams.

- Financial Mastery: Furnstahl’s involvement in capital back and genuine bequest administration is significant, particularly as UC San Diego Wellbeing has progressing capital ventures, counting the redevelopment of its Hillcrest campus.

- Consolidated Vision: The arrangement is anticipated to bind together and fortify the university’s by and large monetary methodology, giving a system-level point of view to budgeting for inquire about, scholastics, and the wellbeing undertaking. This is especially pertinent as the College of California framework proceeds to confront inner weights with respect to operational costs and workforce management.

Would you like me to investigate the particular budgetary challenges OHSU is right now confronting or the points of interest of UC San Diego’s progressing capital ventures?